Home Loan Balance Transfer

Home Loan Balance Transfer

Home Loans are available for the self-construction of a residential property. This is a one-of-a-kind solution for clients who already own land and require finances to finance the construction of a residential house on that site.

Documents Required

KYC Details :

- Applicant & Co- applicant

- Pan Card

- Aadhar card of both

Employment Details :

- Company job offer letter

- Latest 6 months salary pay slips

- Salary crediting account statement for latest 1 year

- In case of cash salary, require salary certificate from employer or company

- If existing loans are running –

sanction letters with loan statement for 1 yr require .. - For any clarification call us on +91 9611077666

Latest 3 Or 2 Or 1yr ITR

1 yr company current (or) saving account statement in case of proprietorship firm.

GST Certificate Or Partnership deed Or Incorporation certificate

GST returns latest 2 yrs

Copy of PAN card

Copy of the telephone or electricity bill

If existing loans are running –

sanction letters with loan statement for 1 yr require ..

For any clarification call us on +91 9611077666

Sale deed

Mother deed of previous transactions

RTC – Revenue track records

Latest property tax paid receipts

Latest Encumbrance certificate ( EC ) on present ownership

Layout plan incase of plot or site purchse

Conversion copy of the land

Any development authority approval letter

Building approved plan

Sale agreement incase of purchase loan with OCR proof

If any documents clarification pls do call us to clarify on +91 9611077666

Existing bank loan sanction letter

Loan account statement of 1 yr.

Mortgage deed of bank which executed by applicant.

Letter of List of documents from existing bank

Frequently Asked Questions

Existing one year old home loan running person is eligible.

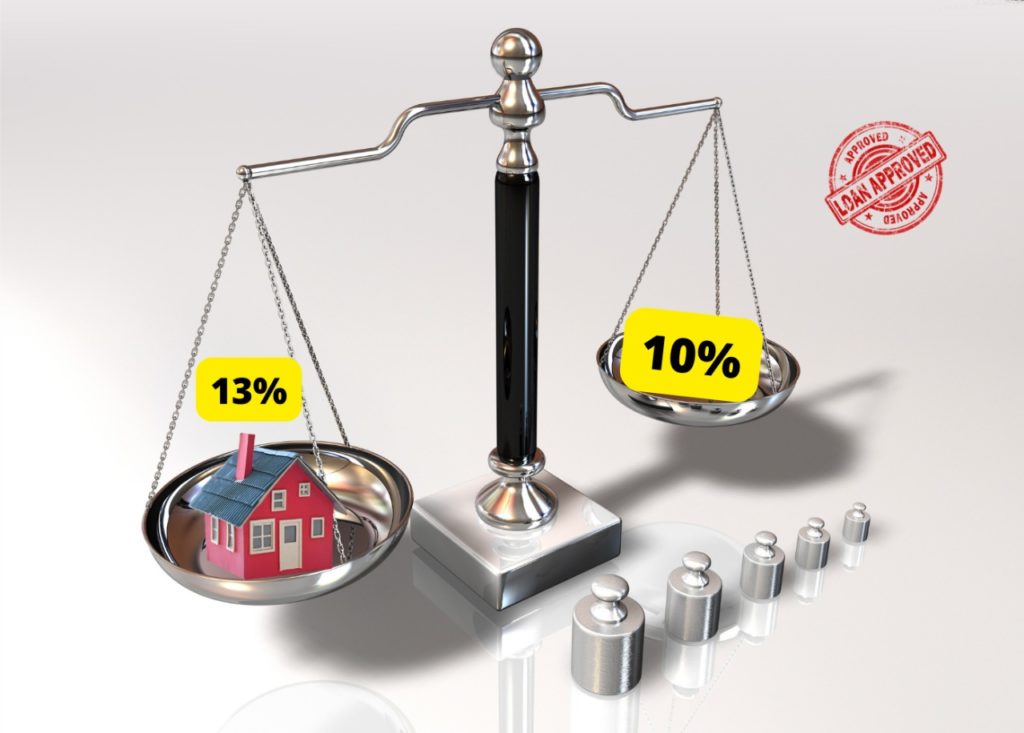

If home loan was taken on higher rate of interest, can still get for lower rate of interest with balance transfer loan.

Yes. If previous bank was sanctioned as home loan., then all tax benefits applicable.

Based on current market valuation of property. will send our valuation engineer and confirm, before we sanction.

Yes. We do consider rental and other incomes, at the time of applying the loan.

Yes. Send us enquiry will discuss and help you..

Got Execute d 35 lakh construction loan of Haqpatra property near Many at a Tech Park Govindpur Bangalore North. Thank you so much To Money Mango.